Car insurance is an essential part of owning a vehicle, and understanding how your premiums are calculated can help you make informed decisions about your coverage and possibly save money. Car insurance rates are influenced by a variety of factors, some of which are within your control, while others are not. In this article, we will explore the top 5 factors that can affect your car insurance rates and provide tips for managing them.

1. Driving History and Claims History

Your driving record is one of the most significant factors that insurers use to determine your car insurance premium. This includes your history of accidents, traffic violations, and claims.

a. Accidents and Traffic Violations

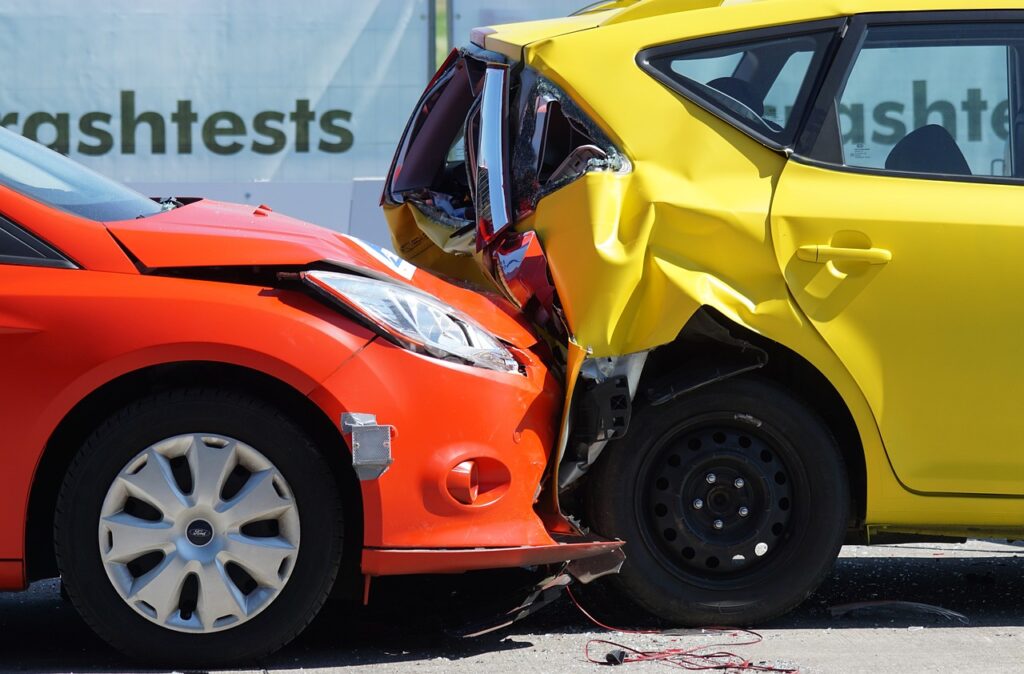

If you have a history of accidents, your insurance premiums are likely to be higher. Insurance companies view drivers who have been involved in accidents as a higher risk, and therefore, they charge them higher rates to account for that risk. The severity of the accidents, whether they were your fault, and the number of incidents can all influence the extent of the premium increase.

Similarly, traffic violations such as speeding tickets, running red lights, or driving under the influence (DUI) can also cause a spike in your premiums. Insurers consider these violations as an indication that you may be more prone to future risky behavior on the road. A clean driving record with no violations or accidents can lead to lower premiums.

b. Claims History

Your history of filing claims also plays a role in determining your insurance rate. If you have filed multiple claims in the past, your insurer may consider you a higher-risk driver and increase your premium accordingly. In some cases, if your claims have involved significant payouts, your insurer may even decide to cancel your policy. On the other hand, drivers who have a low number of claims or none at all tend to be rewarded with lower premiums.

Tips to Manage Your Driving Record:

- Maintain a clean driving record by obeying traffic laws.

- Take defensive driving courses to show that you’re a responsible driver.

- If possible, avoid filing small claims that might raise your premiums.

2. Vehicle Make, Model, and Age

The type of car you drive is another crucial factor that affects your car insurance rates. Insurers consider the make, model, and age of your vehicle to determine how much risk they are taking on by insuring it.

a. Make and Model

High-end luxury cars, sports cars, and high-performance vehicles typically cost more to insure than standard sedans or family cars. This is because these cars are more expensive to repair or replace, and they may be more likely to be involved in high-speed accidents. On the other hand, vehicles known for their safety features, reliability, and lower repair costs tend to attract lower insurance premiums.

For example, cars like the Toyota Prius, Honda Accord, and Subaru Outback tend to have lower insurance rates compared to high-performance cars like the Porsche 911 or the Chevrolet Corvette. Insurance companies may also charge higher premiums for cars with higher theft rates or those that are more prone to damage in accidents.

b. Age of the Vehicle

Newer cars tend to be more expensive to insure because they have a higher value. Insuring a brand-new car typically involves higher premiums due to the higher cost of repair and replacement. As your car gets older, its value decreases, and consequently, the insurance premium may decrease as well. However, if your car is older but still valuable or rare (like a classic car), it may still attract high premiums due to its repair costs or the risk of it being stolen.

On the other hand, an older car that doesn’t have modern safety features, such as airbags, anti-lock brakes, and crash sensors, may be more expensive to insure because it’s considered less safe. Some insurers may even offer discounts for vehicles that are equipped with advanced safety technology.

Tips to Manage Vehicle Factors:

- Consider the long-term costs of insuring a vehicle before purchasing it.

- Opt for cars with good safety ratings and a reputation for reliability.

- If your car is older, evaluate whether it’s worth maintaining comprehensive or collision coverage.

3. Age, Gender, and Marital Status

Your personal demographics, including age, gender, and marital status, significantly influence your car insurance rates. These factors are considered indicators of risk by insurance companies, although they don’t fully define who is or isn’t a safe driver.

a. Age

Younger drivers, particularly teenagers and drivers in their early 20s, are generally charged higher insurance premiums. This is because statistically, younger drivers are more likely to be involved in accidents due to inexperience and riskier driving behaviors. The premiums tend to drop as drivers gain more experience and move into their late 20s or early 30s, as the risk decreases.

Older drivers, especially those over the age of 65, may also face higher premiums due to potential age-related impairments such as slower reflexes and diminished vision, which could increase the likelihood of accidents. However, the increase in premiums is typically less significant compared to younger drivers.

b. Gender

Statistics show that men, especially younger men, are involved in more accidents and tend to drive more aggressively than women. As a result, men may face higher insurance premiums than women, although the gap has narrowed in recent years due to increasing awareness of gender discrimination. In some regions, insurers are prohibited from using gender as a factor when determining premiums.

c. Marital Status

Married drivers are often seen as more responsible and less likely to engage in risky driving behaviors compared to single drivers. As a result, married individuals generally pay lower premiums than their unmarried counterparts. Insurers believe that married people tend to be more stable in their driving habits and are less likely to be involved in accidents.

Tips to Manage Demographic Factors:

- If you’re a young driver, consider taking a driving course or a safe driver program to lower your premiums.

- Married couples can often take advantage of joint policies and benefit from lower rates.

- If you’re an older driver, consider looking for senior driver discounts or policy options that cater to your age group.

4. Location and Driving Habits

Where you live and how you drive can significantly influence your car insurance premiums. Insurers assess the risks based on local factors, such as the frequency of accidents in your area, the risk of theft, and even the availability of repair shops.

a. Location

Car insurance premiums are higher in urban areas compared to rural areas. This is due to the higher likelihood of accidents, theft, and vandalism in cities. In metropolitan areas, where traffic congestion is common, the chances of being involved in a collision are greater. In contrast, rural areas with less traffic tend to see fewer accidents, leading to lower insurance rates.

Additionally, some areas are more prone to natural disasters, such as floods, hailstorms, or wildfires, which can also affect insurance rates. For example, living in a region that frequently experiences hurricanes or snowstorms may result in higher premiums because your vehicle is more likely to sustain damage from these events.

b. Driving Habits

How much you drive also plays a crucial role in determining your insurance premiums. The more you drive, the higher the chance of being involved in an accident, which increases the risk for insurers. If you have a long commute to work or frequently travel long distances, your premium may be higher. In contrast, if you only drive occasionally or have a short daily commute, you may be eligible for lower rates.

Some insurers offer usage-based insurance policies, where your premium is based on the number of miles you drive. If you’re a low-mileage driver, you may be able to save money by opting for such a policy.

Tips to Manage Location and Driving Habits:

- If possible, choose a home in an area with a lower risk of accidents and theft.

- Try to carpool or use public transportation to reduce your annual mileage and lower your rates.

- Look for insurers offering pay-per-mile or usage-based policies if you don’t drive frequently.

5. Credit Score and Financial History

Your credit score can also affect your car insurance premiums. Insurers often use your credit score as an indicator of your financial responsibility, with the assumption that individuals who manage their finances well are less likely to file insurance claims.

a. Credit Score

A higher credit score typically correlates with lower insurance premiums. Insurers believe that people with good credit are more likely to pay attention to safety and maintenance, resulting in fewer accidents. Conversely, individuals with poor credit are often seen as higher-risk drivers, which can result in higher insurance premiums.

In some states, it is illegal for insurers to use credit scores to determine premiums. However, in the majority of states, your credit score can significantly influence your rate. Therefore, maintaining a good credit score can be an effective way to lower your car insurance costs.

b. Financial Responsibility

Your history of paying bills on time, including any outstanding debts or loans, can also impact your insurance premium. If you have a history of missed payments or financial instability, it could indicate that you may be less reliable in other areas of your life, including driving. Insurance companies may raise your premium as a result.

Tips to Manage Credit and Financial History:

- Maintain a good credit score by paying bills on time and reducing debt.

- Regularly check your credit report to ensure there are no errors or fraudulent activity.

- If you have a poor credit score, work on improving it over time to lower your insurance premiums.

Conclusion

Understanding the factors that affect your car insurance rates can help you take steps to manage your premiums. From your driving history and the type of car you own, to your location, age, and credit score, each of these elements plays a significant role in determining how much you’ll pay for car insurance.